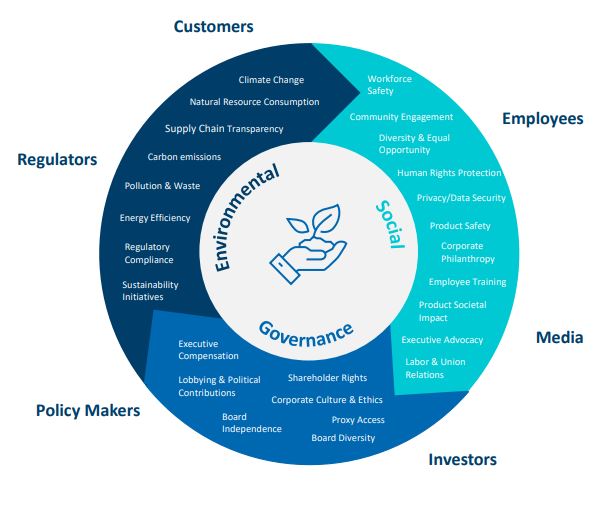

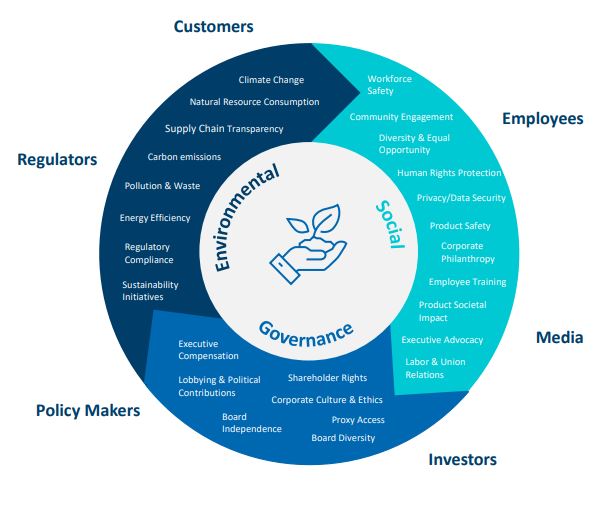

Yesterday, the Independent Petroleum Association of America (IPAA) a major oil & gas association in the U.S., and FTI Consulting, a global business advisory firm with expertise in ESG issues, announced the launch of IPAA’s ESG Center. According to IPAA, the center will advise companies on adapting their schedules into adequate and progressive Environmental, Social, and Governance (ESG) schemes.

The Association’s members, including large oil companies and small families with oil wells assets alike, will support the center by aligning their business strategies into an ESG agenda. According to the Association, this shift will offer them commercial advantages as the sector’s financing has become scarce amid the climate change crisis and an increasing focus on clean energy.

Among the most relevant topics the new center will look to address are building an authentic & highly effective ESG program; provide ESG assessment; design tailored ESG strategies; position leadership training; enhance sustainability reporting; and so much more.

In this sense, the improvements in capital access by an ESG agenda was one main topic at the IPAA’s ESG webinar taking place on Wednesday. After the event, the Association noted: “The approach to environmental, social and governance (ESG) issues across the oil and natural gas industry is an evolving, critical component of a company’s social license to operate. More than anything, ESG is risk management.”

Recommended for you: BP reports profit in 3Q, but recovery remains uncertain

Travis Windle, senior managing director of FTI Consulting, added: “This is not any longer nice-to-have, but it’s critical to long-term stakeholder confidence, investor confidence. This is a new asset class.”

Association’s Center role in context

Windle highlighted the ESG scheme is about access to capital and credit markets and debt markets; about being responsive to institutional investors.

Earlier this month, major companies announced new mergers and acquisitions: ConocoPhillips-Concho, Pioneer-Parsley, and so on. These ventures, all had to do with ESG schemes, as they’ve set carbon-zero goals by 2050.

According to a Financial Times report: “an ESG rating industry has cropped up to meet demand from asset managers. Higher ratings from providers such as MSCI and Sustainalytics can attract money from ESG-conscious investors or bring a company into ESG stock-based indices.”

Therefore, the IPAA’s center will help companies develop ESG Goals and key performance indicators to compete better in the market, and standstill in a changing political and economic landscape in front of the environmental crisis.