Green hydrogen costs need to fall by over a half to be competitive and viable against fossil fuels, S&P Global reported last week.

According to a new report, a 50% fall of prices, to $2 – $2,5 per kilogram, by 2030, would be needed to make this commodity a true contender for the industry.

“We think steep declines in green hydrogen costs are possible by 2030, with reductions resulting from three factors,” the report says.

Those three factors being: reduction in renewable energy costs, reduction in electrolyzer plants capital expenditures, and an increase in capacity utilization factors.

The report highlights a needed reduction in renewable energy production of $20 or $30 per Megawatt hour; while the estimated reduction of capital expenditures for electrolyzers is of 30 to 50%.

As renewable energy constitutes 60% of green hydrogen cost, “a $10/MWh decline in the power price would reduce the cost of hydrogen by $0.4-$0.5/kg,” the report says.

Recommended for you: NY becomes the 4rth state with most renewable-powered electricity in 2019

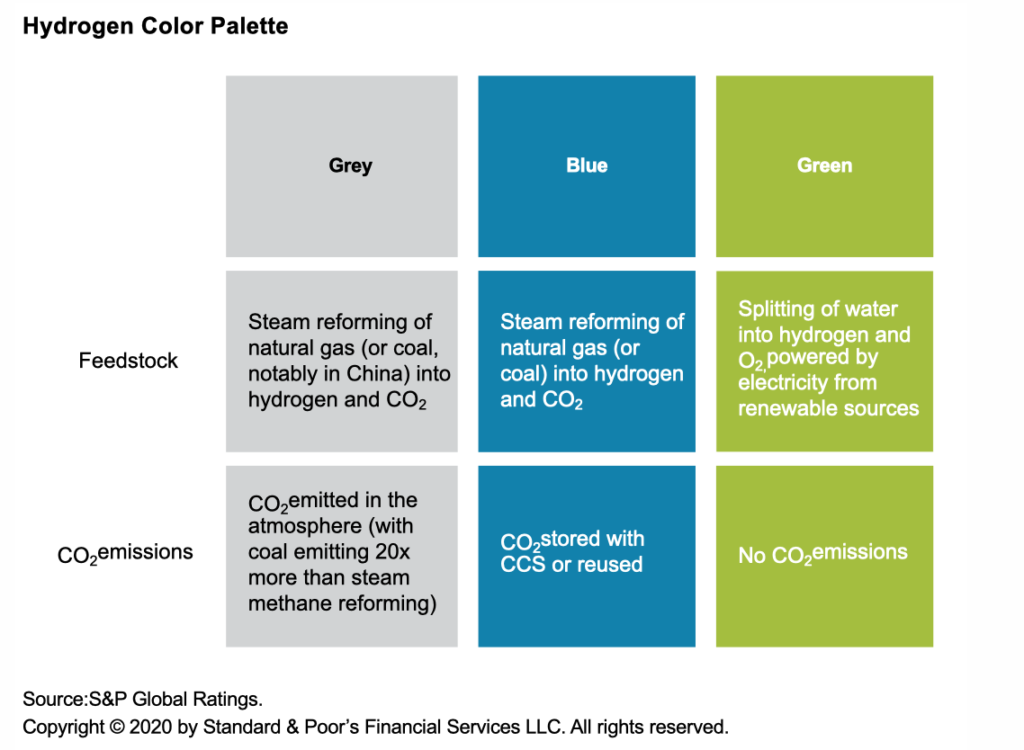

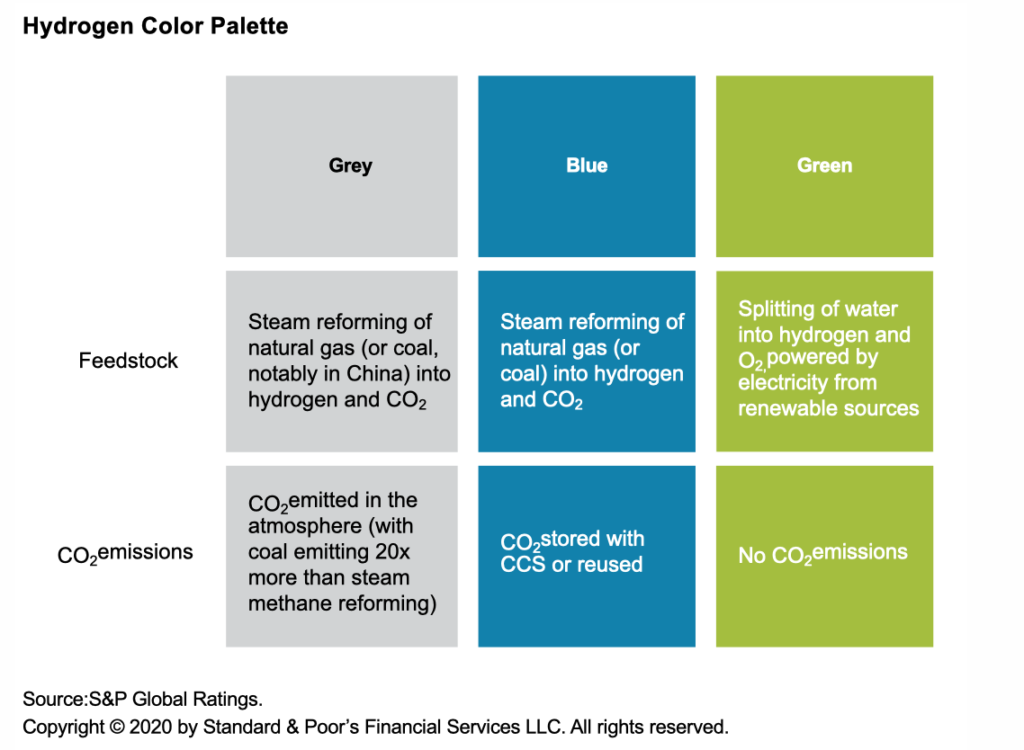

Blue hydrogen more competitive in the short-mid-terms

Meanwhile, a reduction of $250 of capital cost for electrolyzers “would reduce the cost of hydrogen by another $0.3-$0.4/kg.”

Finally, if the capacity utilization factors increase to around 50 or 60%, this commodity costs would see further reductions of $0,2 or $0,4 per kilogram; and if nuclear enters the game, raising electrolysis capacity factors to 90%, costs would reduce by $1 per kilogram.

Simultaneous to this, carbon capture technologies and storage in salt caverns could boost the supply of blue hydrogen. In this sense, as we reported earlier, the Houston-coast area is in a perfect position for delivering scale to this potential industry.

According to S&P, blue hydrogen would be more competitive in the short-mid-terms assuming carbon capture and CO2 storage in salt caverns become a standard for the industry.

About the demand, the report highlights Europe as a main importer of green-blue, from regions with cheaper renewable generation. About delivering supply to demand, the report underlines pipelines as the best way to transport the gas.

“We see the most potential in pipelines, for instance connecting Europe to North Africa’s cheap solar power,” it concludes; as a liquefied supply chain would be costly.