The U.S coal exports have endured significant declines in seven of its top 10 destinations during the third quarter of 2020, S&P Global informed.

Total exports also dropped; only at slow pace they started to recover, since the coronavirus pandemic hit the global market, destroying the demand of many commodities including coal.

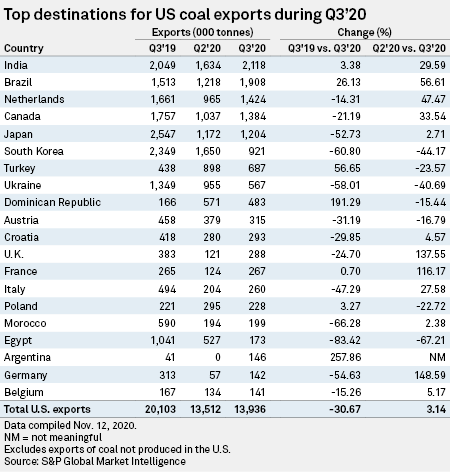

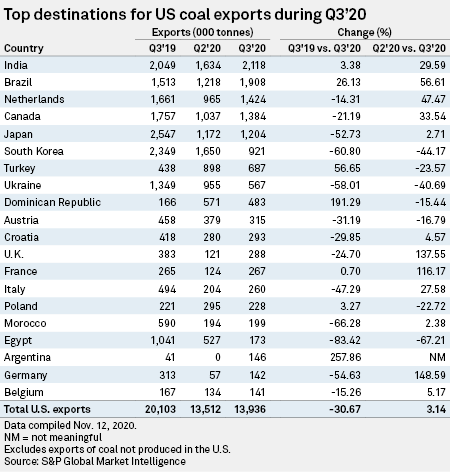

Shipments of coal from the U.S around the world totaled 13,9 million tons, during the third quarter; 30,7% down compared to last year’s same period, according to data reported by S&P Global Market Intelligence.

Nevertheless, they recovered 3,14% compared to the previous quarter of 2020, which could indicate that the global demand for coal and steel is going back to normal, among the accustomed destinations.

Japan was one of the destinations that endured the most reduction, receiving 2,547 tons of coal in 3Q 2019, and just 1,204 in 3Q 2020, which is equal to 52,73% down.

South Korea also had its shipments cut by 60%, receiving 2,349 tons of coal during the 3Q 2019, and just 921 during 3Q 2020.

Recommended to you: Colorado drilling with a new setback of at least 2,000 feet from homes and schools

Coal exports improvements

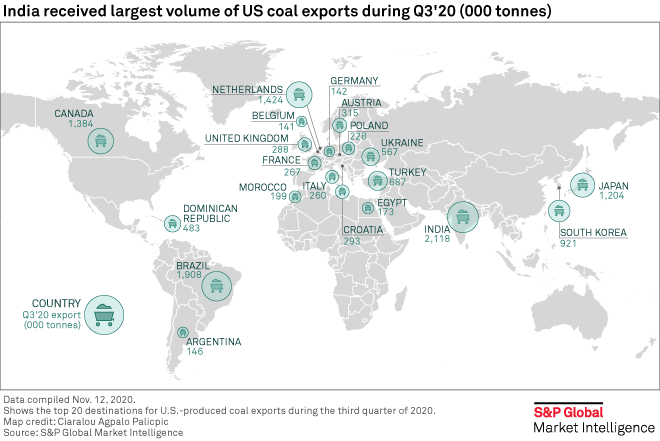

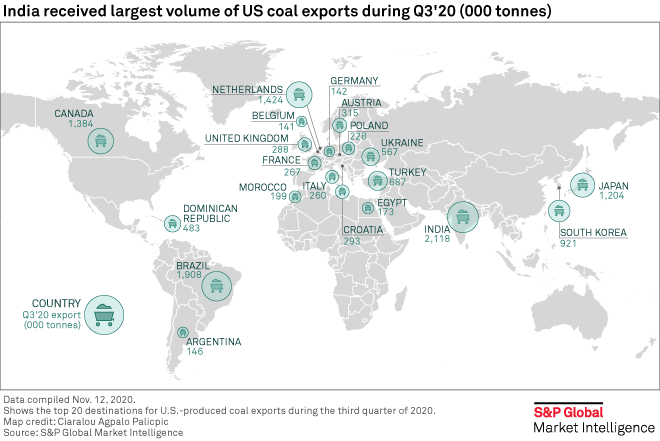

Among the greatest recoveries, was India, with 2,049 tons of coal received in the 3Q of 2019, and 2,118 tons in the latest quarter, which is 3,38% recovery. But, compared to the previous quarter of 2020, the recovery was almost 30%.

India is the number one destination for U.S. coal. According to analysts, this behavior is due to a slow recovery from the initial blow from the pandemic; an ease on restrictions imposed by the Indian government to manage the pandemic.

“The country locked down in the pandemic’s initial days, and the Indian government imposed a mandatory quota on domestic sourcing of coal, which has eased,” S&P report says.

On the other hand, Paul Flynn, CEO at Whitehaven Coal Ltd, said that the recovery was partially attributed to a strong coal demand in India. Demand that may not last long, as the “new wave” of the coronavirus is hitting India pretty hard. He estimates this market behavior may not last into 2021.

However, Moody’s reported that “modest” improvements in the global demand balance of coal are expected to lift its prices, and reflect on steel demand from the automotive and industrial construction sectors. This may reflect on improvements of U.S. coal exports during the 1Q of 2021.